Common Errors that can lead to benefit in kind tax bills

I decided to write this article as I would find the same myths and misconceptions arising time and again with clients from all walks of life. Often is was due to bad or no advice have been received in the past, before they joined The Accounting Studio, and usually the ideas are quite sensible, but unfortunately wrong, or more likely incomplete.

The problem with hidden benefits in kind is that regardless whether you were aware of it or not, you are still expected to report them to HMRC on time and pay the tax, with some quite large fines for any breaches.

So without further delay here are my top error-creating-myths that I am going to try to address today…

My company can pay for my mobile phone, right?

Sort of. Your company can provide you with a mobile phone and you can use that phone personally, but the contract has to be in the company name, not the individual. Just transferring the direct debit or payment for it is not enough, even if it is only used for work. The contract must be in the company name.

The good thing about mobile phones is that although the company can provide you with one, HMRC have kindly allowed that the provision of a single mobile phone that gets used personally is not to be considered a benefit in kind – it is an “exempt benefit”.

I use my broadband for work, I can charge that to the company, right?

We see this question quite a lot, and it makes good sense. Interestingly, if you were self employed and not operating through a company, the broadband cost would be tax deductible, in some respect (and possibly all respects).

In a company, the situation is more tricky. The company can only reimburse you for the marginal additional cost that you have incurred (by which I mean any extra costs you have paid for as a result of your working for the business). With modern broadband packages, particularly home packages, there is no additional cost.

If you ask yourself whether you stopped working that the costs of the broadband would change, very likely it would be no. In this situation HMRC consider the cost to have “duality of purpose” , by which they mean that although you use if for business, but you also use it personally – there is no additional cost.

If you were to charge your broadband to the company HMRC would consider it to be undeclared salary, and taxed (and possibly fined for not declaring it) accordingly.

The short version is that it is almost never possible to charge your home broadband to the company.

If the company, however pays for the broadband, and the contract is with the company, then yes the company can do this. However, by allowing you to use the broadband (assuming you don’t still have a home broadband contract as well), this would be treated as a benefit in kind and also become taxable

I don’t have many expenses, so I can basically pay out whatever is in my bank to me as a dividend, right?

This is a surprisingly common view point and it takes a few steps before there is a benefit in kind but if you take this approach, but stay with me.

Companies have to prepare accounts using the accruals basis – basically meaning not only do you take account of what’s happened in the bank account, but you also care about things like what you owe and what you are owed. This means that the bank balance often serves as a very poor estimate of what you profit actually is.

Even in the simplest of companies, where there is just one invoice per month, and minimal outgoings, there is still corporation tax to be taken into account of. Some of the cash in the bank should really be put aside for paying the corporation tax and not be paid as dividends. If it is paid out it will be considered to be an “illegal dividend”, and this is where the problems start. I’ve covered it in more details here (A small business owners guide to dividends) but the illegal dividend would be reclassified as a director’s loan and often lead to an overdrawn directors loan account. Where this is over £10k at any point interest should be charged on it. If interest is not charged (which it almost always is not, as the director was no aware that the dividends were illegal), then the loan is treated as a beneficial loan on which a benefit in kind has arisen.

It sounds complex, and there are a lot of steps, but this is by far the most common scenario we see with hidden benefits in kind. We can normally sort this out, but it does happen more than you might think.

I can get my company to pay for X and it will be tax deductible, right?

No. Well, yes it will be tax deductible for corporation tax. But it will also be taxable on your personally. So you will save 19% corporation tax, only to pay 20% income tax (plus you will also owe 13.8% in class 1a National insurance tax. If you are higher rate tax payer the situation is worse. You will pay 40% on the costs, not 20%. It is not a good idea. Just say no, kids.

Any time I go anywhere on business I can claim the mileage?

Not quite anywhere but broadly yes, with some key conditions.

- Home to work – its commuting – you can’t claim it.

- Home to an office you often go to – if its a temporary workplace you can claim it. The test is whether you have spent, or are likely to spend, 40% or more of your working time at that particular workplace over a period that lasts, or is likely to last, more than 24 months. If the test is not met, it will be treated as a temporary workplace, and you can claim it

- Home to not your office but somewhere that is basically the same place (like another business on the same street as you) – HMRC would call that commuting as it is substantially the same place – you can’t claim it

- Home office to another office you regularly visit – can’t claim it (see the car crash that was the Dr Samadian case if you are in any doubt), unless it is a temporary work place

- Wholly and exclusively – the trip must be wholly and exclusively for the purpose of business. If it is not then you can’t claim it

You can claim up to 45p per mile for a car for the first 10,000 miles, and then 25p per mile thereafter. There are also different rates for bicycles, motorbikes and additional passengers.

If you do happen to claim for mileage where you should not claim it, or you claim more than the amounts above, that would lead to a benefit in kind.

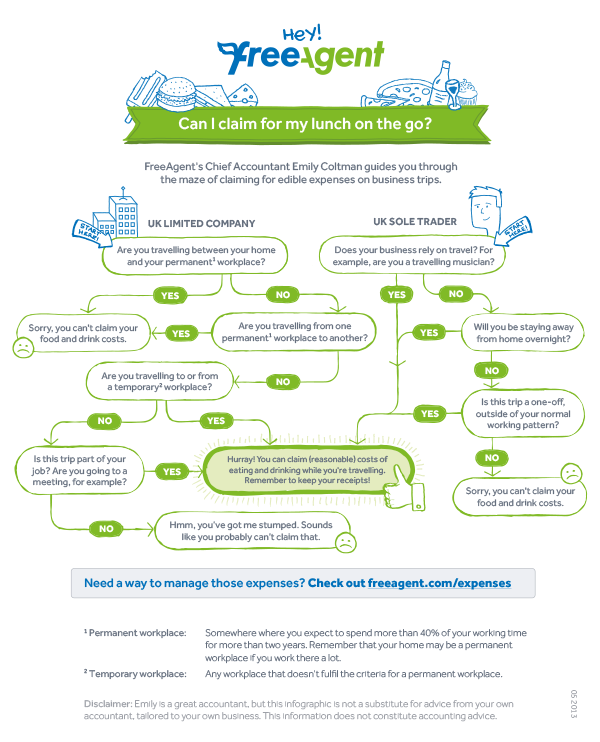

I can get lunch on the company whenever I’m out of the office, right?

The general rule is that if the trip counts as a business trip (see the above question) then you are eligible to claim food.

FreeAgent have produced a brilliant infographic here:

View the full image at FreeAgent

I’m having my meeting down the pub/in a restaurant/at a hotel so that it saves me tax

The company can pay for these things but it will be treated as employee entertaining. The company can claim the expense against it’s corporation tax charge. Where or not the expense is an employee benefit in kind depends on a few things.

To be exempt it needs to be

- open to all your employees

- annual, such as a Christmas party or summer barbecue

- cost £150 (including VAT) or less per person

It might also be exempt if it falls into the trivial benefits rules

If it does not, then the spending will form a benefit on kind for the employee

(I should just point out that even if clients/suppliers etc are there it doesn’t help, and actually makes things worse, as these are not even claimable for corporation tax, unlike employee entertaining, which at least is)

If I visit a customer on holiday, I can claim the holiday as a travel expense, right

Sadly not. This doesn’t often get asked but it does crop up occasionally. The holiday, even if it had a business element would be caught by the duality of purpose rules relating to the wholly and exclusively rules. Basically, just tacking on a business meeting to a ski trip does not make it tax free. If the company paid for it, it would be treated as a benefit in kind and taxed accordingly

That’s not to say there is not something in this though.

For instance, going to a convention in Vegas (related to you business with a real business reason to go), but also relaxing by the pool whilst not at the convention, or spending the evening at a show or at a casino, would not breach the duality of purpose rules (although you would need to personally fund the show tickets/gambling etc). The point is that making the most of it whilst you are there is incidental to the real business reason – attending the convention. You had to stay over in a hotel, and do something with your time whilst not at work, and therefore you are able to get some benefit, that would not be treated as a benefit kind

Conclusion

So there you have it, some relatively common scenarios that may mean you end up with an unexpected tax bill due to benefits in kind.