One of the most tax efficient ways you can get your money out of a company is through making company pension contributions. You need to do it right to get the most from it, but it can be very effective.

Pensions are brilliant, and far from boring!

I should say that actual pension advice is a regulated area, and you will need to take specific advice on pensions from a suitably regulated financial advisor, which we are not – this is an article about saving tax through a pension).

Most people’s eyes glaze over when you talk about pensions. They have a reputation being boring, not to mention complex. Also, its something for ages away, right? Not now – I’ve got real issues that I need to deal with right now, pensions can wait.

The principle, however, is really simple – you save now, into a pension scheme (if it helps – think of it like a bank account), that money is invested in a variety of ways and is used to live on when you retire.

From a tax perspective they are very tax efficient (the government wants us to save for retirement), and so gives various tax benefits for paying into your pension fund.

What you do now makes a massive different to the future

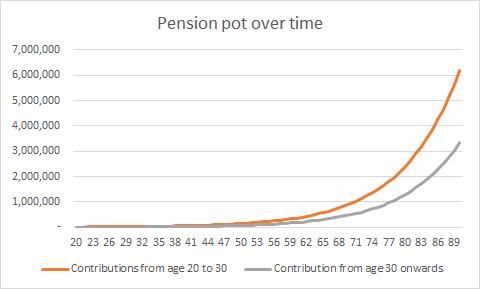

One of my favourite graphs of all time (yes, I have one!) is the one below. It shows the difference to the value of a pension pot between two scenarios. Seeing this in my 20s made a massive difference to how I acted with pensions.

The two scenarios are this

- Ms Orange – an individual invests £1000 per year between the age of 20 to 30 and then stops – completely stops contributing to it.

- Mr Grey – another individual only starts to invest £1000 from the age of 30 and continues forever.

Both individuals get the same return on their investments at 10%.

Not only does Ms Orange have more money at the time of retirement than Mr Grey despite having stopped investing at the age of 30.

No, the really really shocking this is that, at this investment rate Mr Grey will never, ever ever ever have more than Ms Orange. Ever!

Take a moment to let that sink in….

To me, the message was clear – start early

SIPP – your flexible tax efficient friend

To get the maximum tax saving on your pension contributions you will be in need of a self invested personal pension plan, or SIPP. These are pension plans that are owned by the individual and are a bit like ISAs, but for pensions. The point is that the company, really, has very little to do with the scheme.

Now at this point I will often hear clients talk about how they have a company pension scheme for auto-enrolment through NEST, or some other pension provider, with deductions being made through their payroll. This is one method of paying into a pension from a company, but its not the method we are talking about here, as it is really restricted to how much salary you pay, and also restricted in terms of your choice of funds to invest in. To get the big tax savings you need a SIPP.

A good place to start learning about a SIPP is through Money Saving Expert (https://www.moneysavingexpert.com/savings/cheap-sipps/) but do seek out a financial advisor to assist you if you don’t feel comfortable doing it yourself.

Tax Savings on Contributions to a SIPP

Where a company makes a contribution to a SIPP, it is treated, for corporation tax purposes, as being the same as paying salary – its a cost of employment. As such, it reduces the taxable profits in the company, and therefore you pay less corporation tax.

So long as the contributions made from the company are below £40,000 in any one tax year, the tax implications on you individually are nil. You can pay up to £40,000 from the company into a SIPP in any one personal tax year.

How to pay pension contributions into a SIPP

Each SIPP provider will be different in how they want the funds transferred, so you will have to check with them, however from a company perspective, you simply account for the contribution in the same way you would any other cost. There is no reporting to HMRC or anything complicated..

Whether you want to make a contribution on one lump sum, or make a regular contribution is to some extent a personal choice, assuming the SIPP provider allows it. You may want to look into the effects of pound cost averaging for regular investments, but this is drifting into investment advice for which you should consult a financial advisor.